Categories

TOP RATED PRODUCTS

-

DIA CAARE MILLET COOKIES

DIA CAARE MILLET COOKIES

₹22.00Original price was: ₹22.00.₹15.00Current price is: ₹15.00. -

Childrens Choice Millet Cookies - 70gm

Childrens Choice Millet Cookies - 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

Dia Caare Millet Cookies 70gm

Dia Caare Millet Cookies 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

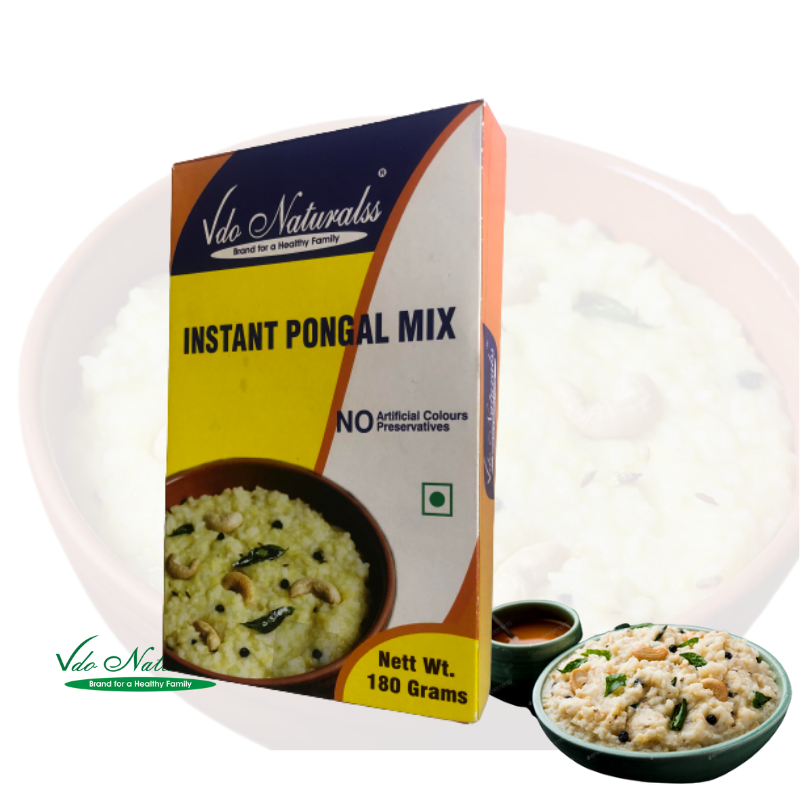

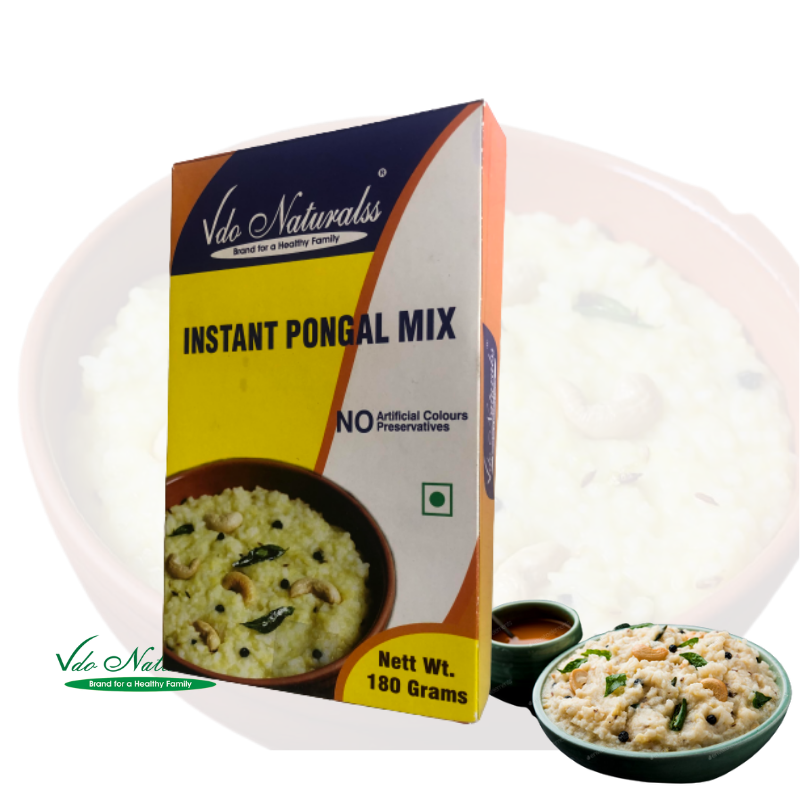

Instant Rice Pongal Mix 180gm

₹65.00

Instant Rice Pongal Mix 180gm

₹65.00

-

Instant Little Pongal Mix

Instant Little Pongal Mix

₹98.00Original price was: ₹98.00.₹73.00Current price is: ₹73.00.

CLIENT'S TESTOMONIAL

Varadharajan

Finest quality and wide range of cold pressed oils. Legacy and natural shop. Best place for buying any oil be that cold pressed coconut , groundnut oil. If you compare the oils available with other branded oils in the market, these are economical and of good quality. The groundnut oil sold by the store is one of the best.

Sandeep

Professional and timely handling of orders. Good customer support. Quality of products is good. Am a repeat customer now! Surprised to see negative reviews of customer support. It is after seven months after the above review: I would 100% recommend. It happened so that during my recent order on receipt I found the packaging was open and two 1 ltr coconut oil were missing, it could be during transit. Was stunned with their response and action. Amazing levels of keeping customer happy. Keep up the levels please!

Apple’s enduring market dominance stems from several interconnected competitive advantages that have allowed it to maintain premium pricing and customer loyalty despite intense competition. These structural advantages have contributed to Apple’s remarkable 48% gross margin and 30% operating margin – exceptional figures for a company of its size in the hardware space. Revenue is expected to rise nearly 6% to $414.4 billion, while bottom-line growth should come in close to 10% at $7.39 per share. If Apple exceeds these estimates, particularly driven by AI-related sales growth, it could see best cloud stocks positive market response. Moreover, the tablet market is also experiencing substantial growth, with shipments up 20% year-over-year in the third quarter of calendar 2024 (according to IDC).

Tesla Stock Mistakes That Cost Investors Thousands

Most analysts consider it a quality core holding for growth- and tech-oriented investors. A balanced long-term growth model suggests Apple could continue compounding steadily into 2030. Structural upside exists if new product categories, such as AR glasses, scale successfully and expand the company’s ecosystem. On the downside, risks include potential disruption to Apple’s core platforms, regulatory interventions, or margin erosion as competition intensifies.

Factors Driving Stock Performance

- Considering the recent macroeconomic challenges, including inflation and declining PC/tablet industry performance, the author emphasizes Apple’s resilience.

- However, they anticipate significant revenue and earnings growth for Apple in fiscal 2025.

- The author posits that sustained performance will depend on managing operational risks and delivering consistent growth to counteract adverse external developments.

- Finally, the stock’s explosive upside potential is characterized by stronger-than-expected guidance from management.

- It’s important to understand how contracts for difference (CFDs) work and assess whether you can afford the potential losses.

- A primary factor is the company’s robust product ecosystem, particularly the strong market reception of its newest products, which continues to drive revenue growth and consumer loyalty.

As of now, Panda has combed through 54 news items directly related to AAPL from the last 30 days. Out of these, 29 clearly showcase a bullish trend, while 8 display bearish tendencies, and 17 events are neutral. Apple pays a modest but steadily growing annual dividend of $1.04, bolstered by aggressive buybacks and recurring free cash flow.

Apple Stock Price Prediction for 2025

Its record of buybacks, dividend hikes, and world-class brand equity keeps institutional and retail holders committed. As of mid-2025, hedge funds and pensions maintain overweight exposure, betting on Apple’s proven playbook of ecosystem expansion and cash generation. The forecast range in this table is based on algorithmic projections provided by CoinCodex. These models use historical price trends, volatility patterns, and moving averages to estimate future stock prices over multiple time horizons.

Does Apple (AAPL) pay a dividend?

Apple generated $387 billion in revenue for fiscal 2024, representing a modest 2.8% growth from the previous year – significantly below its 10-year average of 9.6% annual average. This slowdown reflects challenges in the iPhone segment, which saw just 1.5% growth and declining iPad and Mac sales (-5.2% and -3.1%, respectively). The bright spots have been Services, which grew 15.3% to $96 billion, and wearables, which expanded 6.7% to $42 billion. Ives believes Apple will have a golden era and that it’s just the beginning. He sees Apple’s market cap rising to $5 trillion over the next 12 to 18 months.

The narrative suggests that while Apple’s service segment growth cushions against hardware cyclicality, its reliance on top-tier manufacturing partners could lead to bottlenecks influencing short-term stock momentum. However, high valuation metrics have raised concerns about the stock’s attractiveness at current levels. The author emphasizes that AAPL’s price-to-earnings (P/E) ratio is elevated compared to historical levels, raising doubts about near-term upside potential.

The broader market’s perception of Apple as a tech bellwether further amplifies its sensitivity to external factors, including geopolitical tensions affecting global supply chains. The author posits that sustained performance will depend on managing operational risks and delivering consistent growth to counteract adverse external developments. Macroeconomic factors, particularly interest rate policy driven by the Federal Reserve, play a significant role in shaping market conditions for Apple. The author emphasizes that elevated rates and potential rate hikes could suppress equity markets broadly while pressuring Apple’s valuation, given its dependence on high margins in a competitive premium device sector. Apple raked in $24.8 billion in net income during the latest fiscal quarter (Q ended March 29). Apple offers a strong long-term track record and broad exposure to consumer tech, but its stock faces valuation and regulatory risk.

- However, economic risks and heightened competition may slow down the growth.

- As highlighted by the author, an increasing dependence on higher-margin segments such as services and wearables has bolstered the company’s financial stability and offset potential weaknesses in hardware-driven revenues.

- That extends a long-running streak of rewarding its investors with a favorable capital allocation policy.

- As of now, Panda has combed through 54 news items directly related to AAPL from the last 30 days.

Corn Prices Settle at Thursday’s Closing Levels

We are not a comparison-tool and these offers do not represent all available deposit, investment, loan or credit products. For the overall fiscal year, revenue climbed 2% to $391 billion, but adjusted earnings fell to $6.08 per share from $6.13 per share in fiscal 2023 (factoring in the court’s impact). This indicates strong growth as the fiscal year ended, largely driven by better sales of iPhones, MacBooks, and iPads.

Analysts said that greater confidence in the product cycle and a modest upward revision to revenue forecasts supported the change (MarketBeat, 27 October 2025). The price strength reflects continued demand for the iPhone 17 lineup, with reports indicating solid early sales across China and the U.S. These have helped push Apple’s market value close to $4 trillion, making it the world’s second most valuable company after Nvidia (Reuters, 21 October 2025). Splitting of shares is an increase in the number of securities of the issuing company circulating on the market due to a decrease in their value at constant capitalization.

Additionally, the article underscores Apple’s dependence on hardware sales, namely iPhone revenue, which is cyclical and subject to consumer demand shifts. A slowdown in unit sales or weaker-than-expected performance could amplify investor concerns given the lack of significant traction in Apple’s newer segments such as services. The analysis highlights Apple’s current stock valuation as a potential risk, suggesting it is extended relative to its historical averages and peer comparisons. Such elevated valuations could deter investors, particularly if growth metrics slow, making the market more susceptible to a pullback. Finally, the stock’s explosive upside potential is characterized by stronger-than-expected guidance from management. Combined with a commitment to shareholder value through buybacks and dividends, Apple appears well-positioned to sustain upward momentum in its stock price.

DeLorenzo predicted that the stock will not exceed $270 in 2025 and will likely close the year around $245 per share. This suggests that Apple is likely to see faster growth in fiscal 2025 compared to fiscal 2024. For example, IDC projects shipments of iOS-based iPhones to rise by 3.1% in 2025, whereas Android device shipments are forecasted to grow only 1.7%. LiteFinance Global LLC does not provide services to residents of the EEA countries, USA, Israel, Russia, and some other countries. CoinCodex predicts that the average AAPL price will hover at $384.12 in early 2030, falling to $326.22 in June.

For privacy and data protection related complaints please contact us at Please read our PRIVACY POLICY STATEMENT for more information on handling of personal data. Jason DeLorenzo, the creator of Volland, an option position data service, said institutions believe Apple has an upper bound of $280 by June and $300 by January 2026. However, it’s worth pointing out that not all analysts are as bullish about Apple stock as Ives is.

However, global economic challenges and competition may limit this growth. The article also draws attention to Apple’s future growth prospects, which may be constrained by heightened competition in key markets and potential product maturation. These factors could lead to tempered expectations for revenue growth, possibly limiting significant stock price appreciation. Apple remains among the safest large-cap technology investments due to its exceptional financial strength, loyal customer base, ecosystem advantages and shareholder-friendly capital allocation. However, investors should moderate return expectations compared to the past decade, with future performance likely more closely tracking overall market returns plus a modest premium. This projection assumes 6% annual revenue growth, driven by continued services expansion (12-15% growth), modest iPhone growth (2-3%), and new product categories contributing 5-7% to total revenue by 2030.

Chettinad Snacks

Chettinad Snacks Coconut Oil

Coconut Oil Cookies

Cookies General

General Gingelly Oil

Gingelly Oil Groundnut Oil

Groundnut Oil Herbal

Herbal Instant Mix

Instant Mix Karuppatti

Karuppatti Noodles

Noodles Panchadeepam Oil

Panchadeepam Oil Pongal Mixes

Pongal Mixes

Leave a Reply