Categories

TOP RATED PRODUCTS

-

DIA CAARE MILLET COOKIES

DIA CAARE MILLET COOKIES

₹22.00Original price was: ₹22.00.₹15.00Current price is: ₹15.00. -

Childrens Choice Millet Cookies - 70gm

Childrens Choice Millet Cookies - 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

Dia Caare Millet Cookies 70gm

Dia Caare Millet Cookies 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

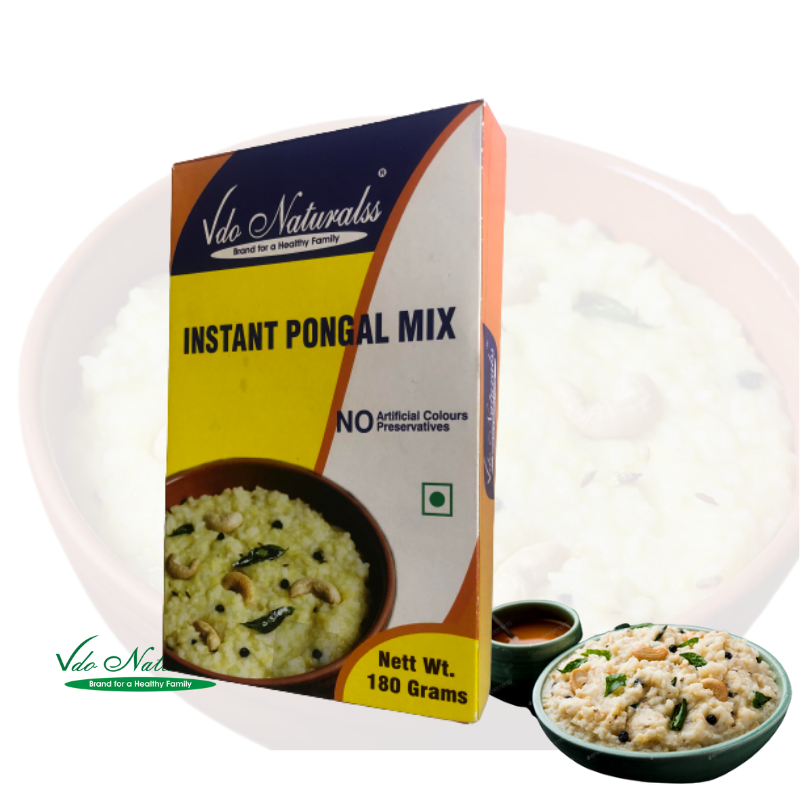

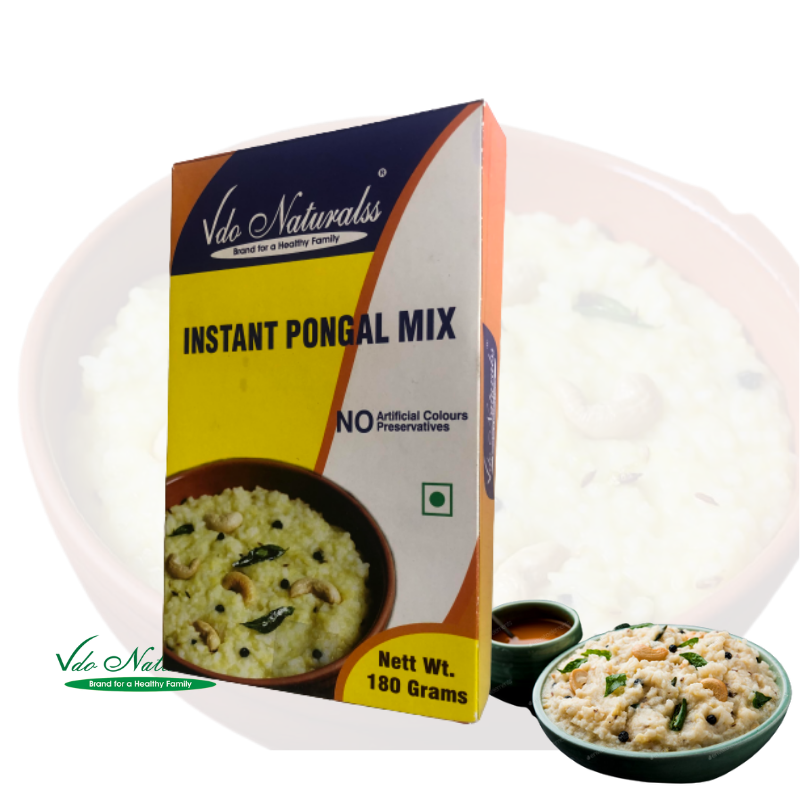

Instant Rice Pongal Mix 180gm

₹65.00

Instant Rice Pongal Mix 180gm

₹65.00

-

Instant Little Pongal Mix

Instant Little Pongal Mix

₹98.00Original price was: ₹98.00.₹73.00Current price is: ₹73.00.

CLIENT'S TESTOMONIAL

Varadharajan

Finest quality and wide range of cold pressed oils. Legacy and natural shop. Best place for buying any oil be that cold pressed coconut , groundnut oil. If you compare the oils available with other branded oils in the market, these are economical and of good quality. The groundnut oil sold by the store is one of the best.

Sandeep

Professional and timely handling of orders. Good customer support. Quality of products is good. Am a repeat customer now! Surprised to see negative reviews of customer support. It is after seven months after the above review: I would 100% recommend. It happened so that during my recent order on receipt I found the packaging was open and two 1 ltr coconut oil were missing, it could be during transit. Was stunned with their response and action. Amazing levels of keeping customer happy. Keep up the levels please!

Annual turnover is the percentage rate at which mutual funds or ETFs replace their investment holdings. Calculating turnover rates can be useful in gauging how actively a fund is managed and its efficiency. Both high and low turnover rates can have different implications for fund quality and performance, and alone are not reliable indicators. Actively and passively managed funds have distinct characteristics and turnover rates, with growth funds typically showing higher rates due to active trading strategies. Turnover rates are also important when examining business inventory turnover and its impact on performance.

Improving Your Investment Turnover Ratio

- Conversely, passive investors view a low turnover rate as a way to minimize transaction costs and taxes, which can erode returns over time.

- So when you are comparing firms from an investor’s perspective, a company with a higher ratio is the best to trust with your capital as it has a higher chance of outperforming competitors.

- On the other hand, Telecommunications, Media & Technology (TMT) may have a low total asset turnover due to their high asset base.

- Actively managed mutual funds with a low turnover ratio reflect a buy-and-hold investment strategy.

Thus, there is a mismatch between the time period covered in the numerator and denominator. As it includes both purchases and sales of securities, the regulator also requires an additional explanation where applicable. For instance, a machine that has been running for 10 years can be replaced with a brand new one with better capacities. You must account for the depreciation of worn-out assets and replace them with newer ones. This way, you keep stashing out underperforming assets or digital ware from your https://www.bookstime.com/ manufacturing hubs or service-oriented firms.

Q. Can asset turnover be too high?

Technological tools for monitoring investment turnover offer investors a powerful array of resources to fine-tune their trading activities. The key is to select the right combination of tools that align with one’s investment philosophy and to use the insights gained from these tools to make informed decisions. Ultimately, the key to optimizing your investment turnover rate lies in a deep understanding of your financial objectives, risk tolerance, and the market environment. By carefully considering these factors and employing the strategies listed above, you can tailor your turnover rate to suit your individual investment style and goals. Remember, there is no one-size-fits-all approach, and what works for one investor may not work for another. Understanding the basics of capital turnover is essential for anyone involved in the financial aspects of a business.

- The fund also sold $120 million of equities and long-term bonds during the year.

- The key is to select the right combination of tools that align with one’s investment philosophy and to use the insights gained from these tools to make informed decisions.

- Or a manufacturing company that invests in advanced robotics, boosting production without a proportional increase in assets.

- Whether an investor chooses a high or low turnover approach, the key is to understand the underlying factors driving market movements and to apply a consistent, well-reasoned strategy.

Video Explanation of Fixed Asset Turnover Ratio

High turnover rates were once seen as a hallmark of active management and a means to capitalize on market inefficiencies. However, the rise of passive investment strategies and the increasing importance of Payroll Taxes sustainable, long-term growth are reshaping perceptions. Conversely, passive investment strategies typically exhibit lower turnover rates. Advocates of this approach, such as followers of the efficient market hypothesis, believe that markets are generally efficient, making it difficult to consistently outperform through active trading. By holding assets for longer periods, passive strategies aim to reduce transaction costs and defer tax liabilities, potentially enhancing ROI. An example of this is an index fund that mirrors a market index and only adjusts its holdings when the index itself changes.

The asset turnover ratio measures the efficiency of a company’s assets in generating revenue or sales. It compares the dollar amount of sales to its total assets as an annualized percentage. Thus, to calculate the asset turnover ratio, divide net sales or revenue by the average total assets.

The Basic Components of the Calculation

The best approach for a company to improve its total asset turnover is to improve its efficiency in generating revenue. Check out our debt to asset ratio calculator and fixed asset turnover ratio calculator to understand more on this topic. This implies that Mutual Fund A replaces about 27.27% of its holdings every year. Given this relatively low turnover ratio, we can infer that the fund managers are more likely to employ a “buy and hold” strategy rather than active trading. As an example, the XYZ fund purchased $100 million of stocks and $20 million of 6-month Treasury bills.

- It may indicate a strategy that seeks to capitalize on short-term market movements.

- The Total Asset Turnover Ratio takes into account every asset under a company’s control, from office supplies to sophisticated IT systems.

- It’s important to note that the period in question should align with the period used to measure net sales to ensure consistency in the calculation.

- Companies can better assess the efficiency of their operations by looking at a range of these ratios.

- Asset Turnover is calculated by taking the net sales for a period and dividing by the average total assets for the same spell.

A higher ratio indicates better efficiency, while a lower ratio suggests poor use of assets, possibly due to underutilized fixed assets, weak collections, or poor inventory management. Comparisons should only be made within the same industry, as capital intensity varies widely. How you evaluate an ROI figure in the long run depends heavily on the sector in which the company is active or makes investments. Many business professionals aim for a return on investment that is more than 10 percent.

- A high ratio can mean that companies are successful at converting assets into revenue.

- A good investment turnover ratio for the retail industry ranges between 2.5 to 4.

- A problem may arise however, since the seller has no incentive to produce theextra product.

- It’s essential to recognize that low turnover can result in reduced transaction fees, positively affecting your portfolio’s overall performance.

- A value peaking above 1 whispers tales of effectiveness, showcasing that a company has been adept at using its assets to concoct a sum of sales exceeding the total value of its assets.

Significance of Asset Turnover in Financial Analysis

As is the case with most metrics of this type, the ratio should be measured over time and benchmarked against companies in the same industry. Investors, on the other hand, often use capital turnover as one of the many factors to assess the attractiveness of a potential investment. A company that consistently maintains a high capital turnover ratio might be seen as a more dynamic and potentially lucrative investment than one with lower turnover. The inventory turnover ratios formula measures how efficiently and quickly the business is able to sell the old stock and replace it with new stock of goods. Asset turnover reflects how efficiently a business can use its assets to produce revenues.

The Link Between Turnover and ROI

While turnover can be a critical factor in understanding expenses and taxes, it’s not a standalone measure of a fund’s success. A fund with high turnover could still outperform if it consistently captures profitable trades. Let’s say a mutual fund has total purchases of $10 million and total sales of $5 million during the year. A well-performing fund with low turnover may indicate a successful value-driven investment strategy, whereas high turnover might hint investment turnover formula at a more speculative approach. Generally, a high total asset turnover is better as it means the company can generate more revenue per asset base.

Chettinad Snacks

Chettinad Snacks Coconut Oil

Coconut Oil Cookies

Cookies General

General Gingelly Oil

Gingelly Oil Groundnut Oil

Groundnut Oil Herbal

Herbal Instant Mix

Instant Mix Karuppatti

Karuppatti Noodles

Noodles Panchadeepam Oil

Panchadeepam Oil Pongal Mixes

Pongal Mixes

Leave a Reply