Categories

TOP RATED PRODUCTS

-

DIA CAARE MILLET COOKIES

DIA CAARE MILLET COOKIES

₹22.00Original price was: ₹22.00.₹15.00Current price is: ₹15.00. -

Childrens Choice Millet Cookies - 70gm

Childrens Choice Millet Cookies - 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

Dia Caare Millet Cookies 70gm

Dia Caare Millet Cookies 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

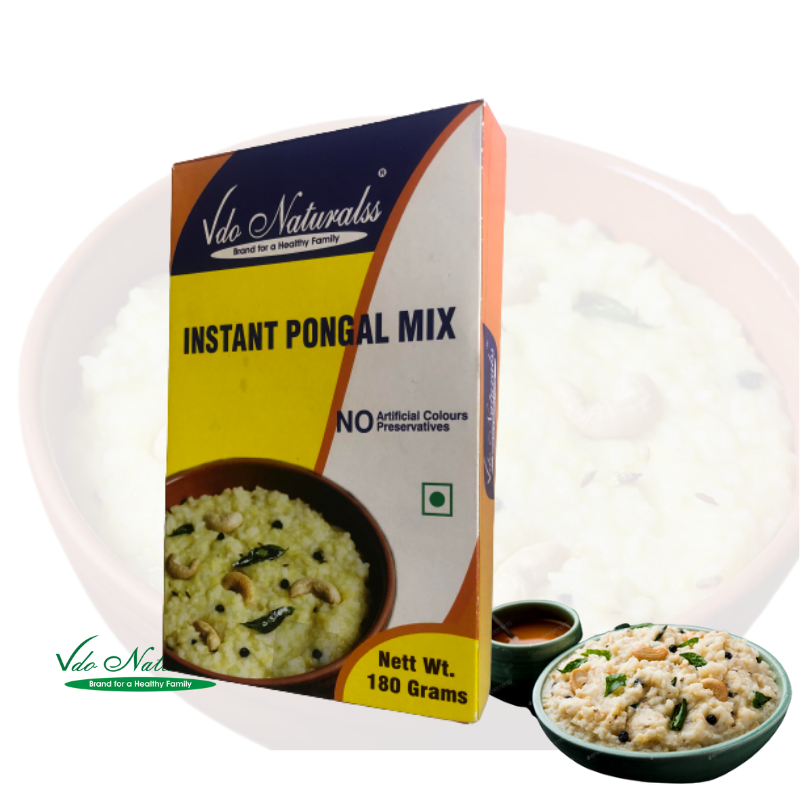

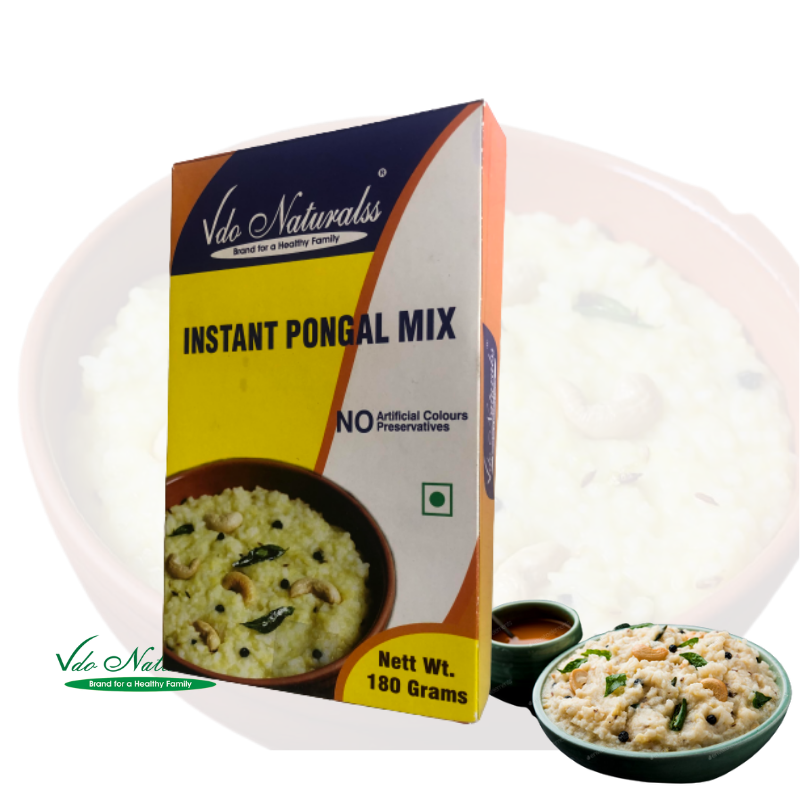

Instant Rice Pongal Mix 180gm

₹65.00

Instant Rice Pongal Mix 180gm

₹65.00

-

Instant Little Pongal Mix

Instant Little Pongal Mix

₹98.00Original price was: ₹98.00.₹73.00Current price is: ₹73.00.

CLIENT'S TESTOMONIAL

Varadharajan

Finest quality and wide range of cold pressed oils. Legacy and natural shop. Best place for buying any oil be that cold pressed coconut , groundnut oil. If you compare the oils available with other branded oils in the market, these are economical and of good quality. The groundnut oil sold by the store is one of the best.

Sandeep

Professional and timely handling of orders. Good customer support. Quality of products is good. Am a repeat customer now! Surprised to see negative reviews of customer support. It is after seven months after the above review: I would 100% recommend. It happened so that during my recent order on receipt I found the packaging was open and two 1 ltr coconut oil were missing, it could be during transit. Was stunned with their response and action. Amazing levels of keeping customer happy. Keep up the levels please!

You should solely have interaction in any such activity solely if you are totally conscious of the related risks. Thus, traders from different geographical areas of the world can conduct trades easily. Regulatory bodies are looking for a steadiness between encouraging innovation and defending buyers. Policymakers wish to support these new buying and selling platforms whereas preserving the market secure and fair. The world of ATS is growing, giving traders extra methods to take care of today’s markets. Auto buying and selling systems are a core part of direct entry brokers and day trading professionals.

- Not Like traditional exchanges, ATS platforms allow confidential execution, making certain that enormous orders do not disrupt market costs.

- Market data suppliers furnish ATSs with real-time updates on costs and market situations.

- Dark swimming pools entail trading on an ATS by institutional orders executed on private exchanges.

- Understanding the mannequin lets compliance and danger groups set smart insurance policies (for example, “only canonical bridges for consumer funds; liquidity bridges for internal rebalancing with limits”).

- They offer new methods for buyers around the globe to search out alternatives.

Knowledge dealing with.Insurance Policies overlaying information barriers and information utilization are central. Merchants should review dealer disclosures to understand whether venue-level knowledge can affect routing or market making. Price discovery.As A End Result Of many ATSs reference the NBBO, exchanges stay the anchor for price discovery. Nonetheless, heavy ATS participation can dampen displayed depth, sometimes resulting in sharper moves on lit books during information occasions.

Advantages Of Using Different Trading Methods

Create a Trading Account now and be a half of a world-class trading platform. By not displaying order info publicly, crossing networks might help forestall info leakage, protecting the pursuits of participants Digital asset management. This can be notably useful for institutional traders who must trade large volumes of securities with out revealing their intentions to the market. The darkish pool different transaction system is probably the most distinguished ATS kind.

Greatest Forex Dealer

Regulatory considerations are one other potential drawback of crossing networks. While these networks are regulated by the identical authorities as conventional exchanges, their operation can raise distinctive regulatory challenges. For instance, the lack of transparency could make it difficult for regulators to observe trading exercise and guarantee market fairness. Once a match is discovered, the commerce is executed, and the major points are reported to the relevant regulatory authority.

False Breakouts In Trading: The Signals Most Traders Miss

Throughout an economic downturn, many traders declare to have efficient methods to beat the system and nonetheless maximize profits. For instance, if a trading system that trades throughout a bear market is making a lot of profits when the markets are falling, it doesn’t mean much. The buying and selling system must also be tested throughout a market uptrend as nicely. Relying on the buying and selling platform you may be using, there are different programming languages that can be utilized to automate your trading strategies. It is simple for a trading system to commerce based mostly on rules in comparison with a dealer where feelings can play a giant position within the buying and selling consequence. Since the market is nothing more than the emotional sum of its members, an auto trading system will permit a trader to separate themselves from the noise and feelings.

Nevertheless, most ATSs operate ats full form in banking on a steady foundation, matching orders as they come in somewhat than at specific times. An trade is a marketplace the place securities, commodities, and different financial instruments are traded. Institutions regularly use private exchanges to purchase and promote securities in high quantities via block transactions. These establishments include mutual funds, retirement funds, and insurance companies.

The financial markets are changing quick, thanks to various buying and selling techniques (ATS). They embody electronic communication networks (ECNs), dark pools, and crossing networks. The introduction of ATS has had a selection of constructive impacts on the monetary markets.

FINRA has established a quantity of guidelines and rules that govern the operation of ATS, including guidelines relating to the disclosure of material data to investors. This registration course of requires ATS to supply detailed details about their operations, together with their buying and selling policies and procedures. ATS should also comply with the SEC’s guidelines relating to the disclosure of material data to buyers. Additionally, the usage of subtle algorithms to match orders can raise concerns about algorithmic trading and its potential impact on market stability. Regulators around the globe are more and more scrutinizing these practices to ensure they do not pose a threat to the market. A narrower bid-ask spread means that individuals can commerce at extra favorable prices.

Your USDC on Chain A is paid out from a pool on Chain B, then the community https://www.xcritical.in/ settles later. Pace is high; risk shifts to the network’s solvency and routing ensures. Later, you withdraw again to mainnet by way of the identical canonical (official) bridge. In practice, bridges turn a set of separate blockchains into a portfolio of related environments that users can route through primarily based on fees, liquidity, and alternative.

Chettinad Snacks

Chettinad Snacks Coconut Oil

Coconut Oil Cookies

Cookies General

General Gingelly Oil

Gingelly Oil Groundnut Oil

Groundnut Oil Herbal

Herbal Instant Mix

Instant Mix Karuppatti

Karuppatti Noodles

Noodles Panchadeepam Oil

Panchadeepam Oil Pongal Mixes

Pongal Mixes

Leave a Reply