Categories

TOP RATED PRODUCTS

-

DIA CAARE MILLET COOKIES

DIA CAARE MILLET COOKIES

₹22.00Original price was: ₹22.00.₹15.00Current price is: ₹15.00. -

Childrens Choice Millet Cookies - 70gm

Childrens Choice Millet Cookies - 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

Dia Caare Millet Cookies 70gm

Dia Caare Millet Cookies 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

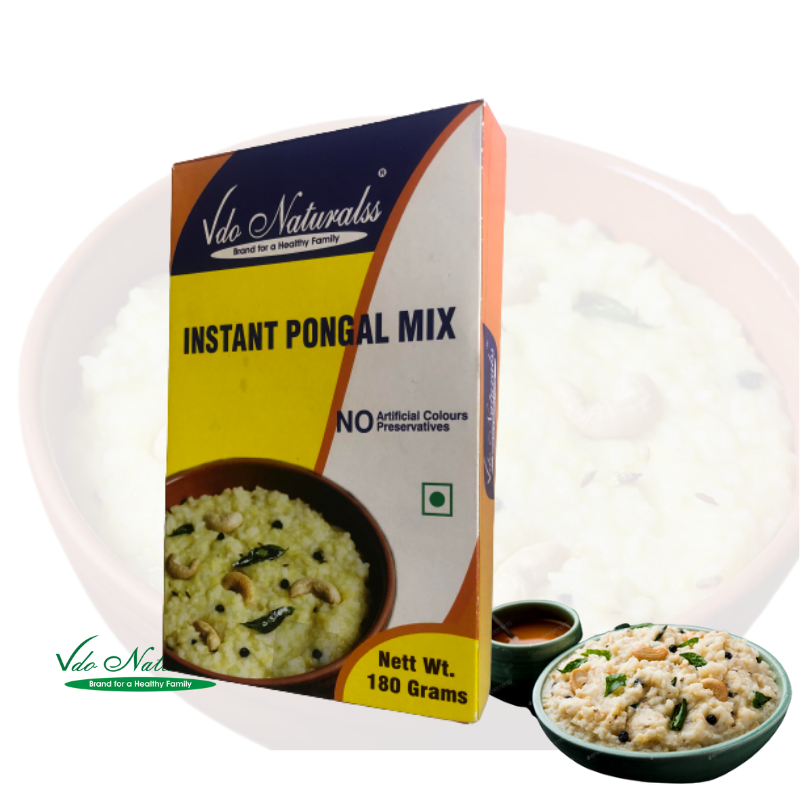

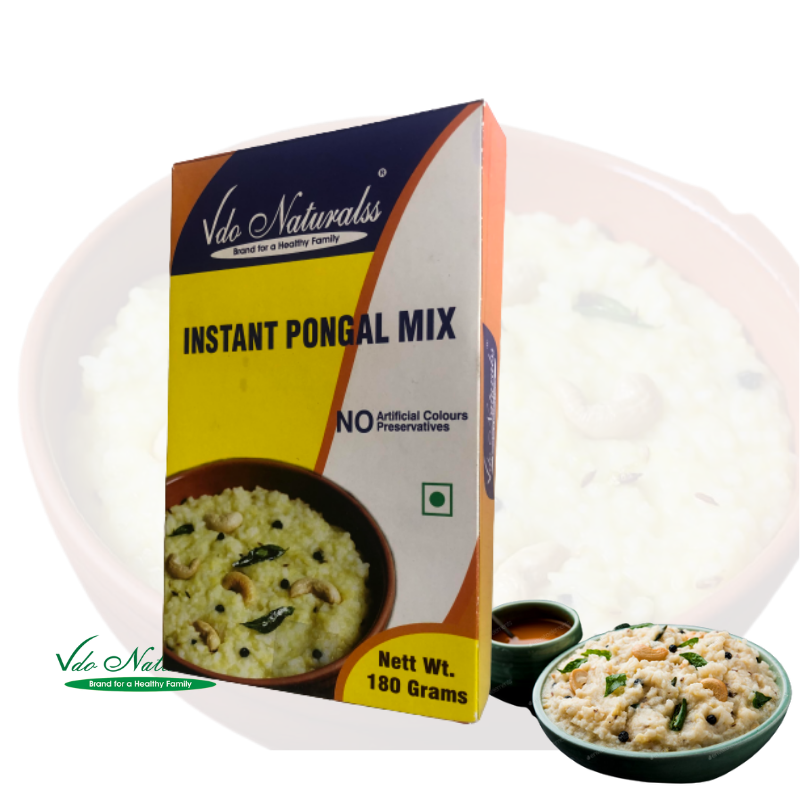

Instant Rice Pongal Mix 180gm

₹65.00

Instant Rice Pongal Mix 180gm

₹65.00

-

Instant Little Pongal Mix

Instant Little Pongal Mix

₹98.00Original price was: ₹98.00.₹73.00Current price is: ₹73.00.

CLIENT'S TESTOMONIAL

Varadharajan

Finest quality and wide range of cold pressed oils. Legacy and natural shop. Best place for buying any oil be that cold pressed coconut , groundnut oil. If you compare the oils available with other branded oils in the market, these are economical and of good quality. The groundnut oil sold by the store is one of the best.

Sandeep

Professional and timely handling of orders. Good customer support. Quality of products is good. Am a repeat customer now! Surprised to see negative reviews of customer support. It is after seven months after the above review: I would 100% recommend. It happened so that during my recent order on receipt I found the packaging was open and two 1 ltr coconut oil were missing, it could be during transit. Was stunned with their response and action. Amazing levels of keeping customer happy. Keep up the levels please!

For most customers, exchanges are the entry point into the world of digital assets. Even after an initial purchase, you’ll usually use an change again to swap tokens, rebalance a portfolio, or cash out profits. As a outcome, exchanges have turn out to be both a gateway and an important infrastructure layer for the complete crypto ecosystem. Transactions are peer-to-peer, that means customers work together instantly with one another to buy and sell cryptocurrencies. Liquidity suppliers additionally face numerous dangers including impermanent loss, which is a direct results of depositing two belongings for a particular buying and selling pair.

In the united states, people typically use Bitcoin in its place funding, serving to diversify a portfolio aside from shares and bonds. You also can use Bitcoin to make purchases, but there are some vendors that settle for the original crypto. It was potential for the typical particular person to mine Bitcoin in the what is a decentralized crypto exchange early days, however that’s no longer the case.

For example, if you owned 1k price of ether (ETH) and 1k price of USD Coin (USDC), you contribute each of these cryptos to an ETH/USDC liquidity pool on any DEX you need. Yes, You can entry DEX trading on the OKX app, which offers superior commerce execution and unlocks an enormous vary of latest opportunities. OKX’s bridge and wallet solutions enable safe, efficient asset transfers throughout many chains, making it easier than ever to navigate a multi-chain world without leaving the OKX platform. OKX has a long track record of platform transparency, common third-party audits, and high consumer safety standards—qualities you should look for each on CEXs and in any DEX integration. You can even use a service that allows you to join a debit card to your crypto account, that means you can use Bitcoin the same method you’d use a bank card.

Step 2: Select Token And Network

This decentralized structure minimizes risks tied to single factors of failure, providing an inherently extra resilient framework. DEX charges differ from CEXs in that they do not seem to be https://www.xcritical.com/ usually controlled by a government. As A Substitute, prices can embody network transaction fees often known as fuel, plus any platform-specific charges. While there are no standard withdrawal charges imposed by the platform (since person funds remain in person custody), on-chain actions like swapping or moving tokens to a different wallet nonetheless incur blockchain fees. Charges may fluctuate due to market volatility, community congestion, or totally different governance choices within the decentralized finance (DeFi) ecosystem.

The Most Effective Crypto Hardware Wallets For 2024 Which Pockets Is Greatest For You?

- Not Like centralized exchanges that need to individually vet tokens and guarantee they adjust to native laws before itemizing them, DEXs can embrace any token minted on the blockchain they’re built upon.

- These platforms are reworking how people access digital assets, providing open, permissionless alternate options to traditional markets.

- Liquidity limitations – Trading volumes and liquidity swimming pools are typically lower compared to centralized exchanges.

Funds remain in consumer wallets, and sensible contracts handle the trading course of. Although this eliminates the chance of dropping funds to a centralized failure, it introduces new risks similar to smart-contract bugs, bridge vulnerabilities, and technical exploits. Every model has risks; the distinction lies in whether the main risk comes from human control or code. Some decentralized exchanges maintain on-chain or off-chain order books, matching purchase and promote orders much like a CEX.

They are built on prime of layer-one protocols, which means that they’re constructed directly on the blockchain. DEXs were created to remove the requirement for any authority to supervise and authorize trades performed inside a particular exchange. Decentralized exchanges enable for peer-to-peer (P2P) trading of cryptocurrencies. Peer-to-peer refers to a marketplace that hyperlinks patrons and sellers of cryptocurrencies. They are often non-custodial, which means users hold management of their wallet’s private keys. A non-public key is a kind of advanced encryption that enables users to access their cryptocurrencies.

What Are A Number Of The Cons Of Decentralized Exchanges?

It permits users to create liquidity pools with as much as eight tokens, with flexible weights, offering a high degree of customization. Nonetheless, in addition they face dangers, such as impermanent loss, which might occur when one asset in a trading pair is extra unstable than the opposite. For instance, Automated Market Makers (AMMs) utilize sensible contracts to set the worth of traded property, whereas Order Book DEXs compile information of all open orders for specific asset pairs. Decentralized exchanges nowadays let customers borrow funds to leverage their positions, lend funds to passively earn curiosity, or present liquidity to gather trading charges. When customers exchange one cryptocurrency for one more, their anonymity is preserved on DEXs. In distinction to centralized exchanges, users do not must go through a normal identification process often recognized as Know Your Customer (KYC).

A Complete Guide To Defi Yield Aggregators

They’re functions built on blockchain networks (like Ethereum or BNB Chain) that use good contracts to automate trades and swaps. Instead of matching patrons and sellers through a conventional order book, DEXs often use automated market makers (AMMs) or direct peer-to-peer mechanisms. This trustless mannequin eliminates the need for banks or brokers, boosting transparency and censorship resistance inside the crypto buying and selling process. Decentralized exchanges (DEXs) are peer-to-peer cryptocurrency buying and selling platforms that operate with out a central authority.

If the extremely volatile asset’s worth rises while the amount liquidity providers hold drops, liquidity suppliers undergo an impermanent loss. The loss is impermanent because the price of the asset can still transfer back up and trades on the trade can balance the pair’s ratio. The pair’s ratio describes the proportion of each asset held within the liquidity pool.

To use a DEX, you need a non-custodial crypto wallet like MetaMask, Belief Pockets, or Rabby. Simply connect your wallet via the DEX interface utilizing Blockchain an Internet connection. As the cryptocurrency ecosystem evolves, DEXs are more probably to play an increasingly necessary role in empowering people and promoting monetary sovereignty.

Chettinad Snacks

Chettinad Snacks Coconut Oil

Coconut Oil Cookies

Cookies General

General Gingelly Oil

Gingelly Oil Groundnut Oil

Groundnut Oil Herbal

Herbal Instant Mix

Instant Mix Karuppatti

Karuppatti Noodles

Noodles Panchadeepam Oil

Panchadeepam Oil Pongal Mixes

Pongal Mixes

Leave a Reply