Categories

TOP RATED PRODUCTS

-

DIA CAARE MILLET COOKIES

DIA CAARE MILLET COOKIES

₹22.00Original price was: ₹22.00.₹15.00Current price is: ₹15.00. -

Childrens Choice Millet Cookies - 70gm

Childrens Choice Millet Cookies - 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

Dia Caare Millet Cookies 70gm

Dia Caare Millet Cookies 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

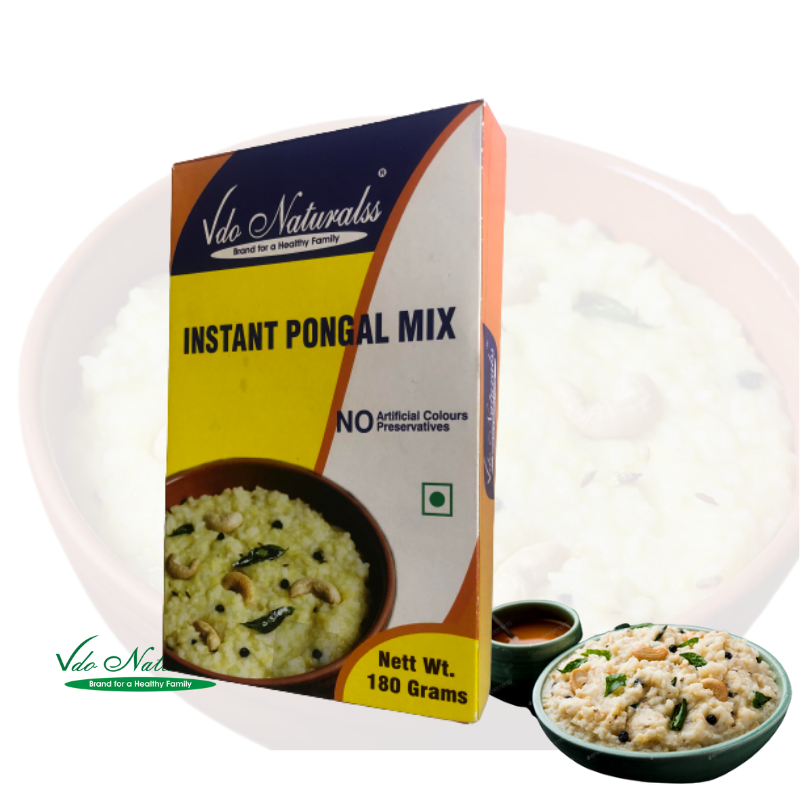

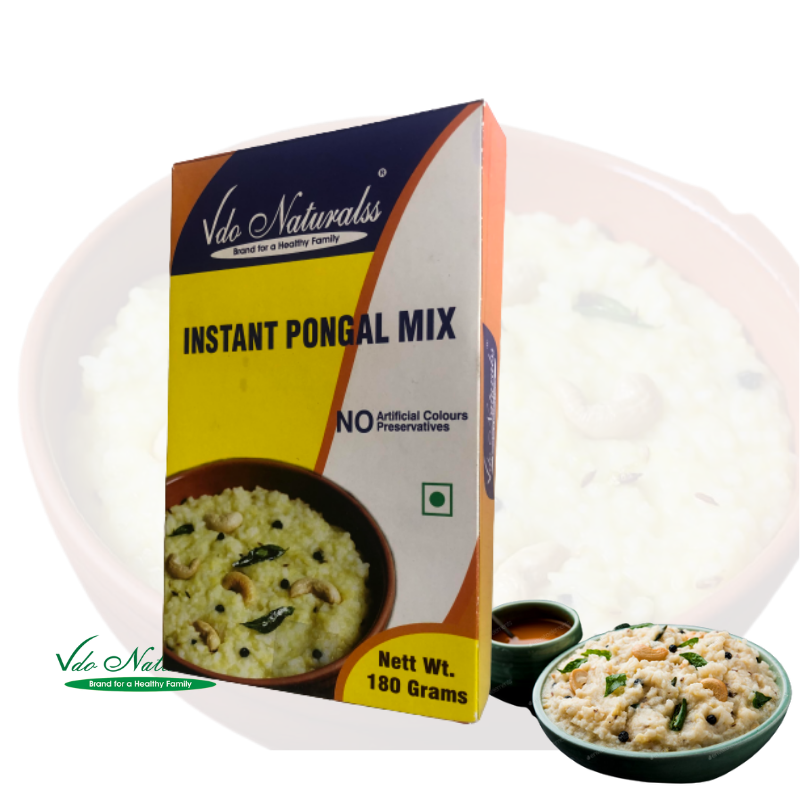

Instant Rice Pongal Mix 180gm

₹65.00

Instant Rice Pongal Mix 180gm

₹65.00

-

Instant Little Pongal Mix

Instant Little Pongal Mix

₹98.00Original price was: ₹98.00.₹73.00Current price is: ₹73.00.

CLIENT'S TESTOMONIAL

Varadharajan

Finest quality and wide range of cold pressed oils. Legacy and natural shop. Best place for buying any oil be that cold pressed coconut , groundnut oil. If you compare the oils available with other branded oils in the market, these are economical and of good quality. The groundnut oil sold by the store is one of the best.

Sandeep

Professional and timely handling of orders. Good customer support. Quality of products is good. Am a repeat customer now! Surprised to see negative reviews of customer support. It is after seven months after the above review: I would 100% recommend. It happened so that during my recent order on receipt I found the packaging was open and two 1 ltr coconut oil were missing, it could be during transit. Was stunned with their response and action. Amazing levels of keeping customer happy. Keep up the levels please!

A short position is ‘closed’ once the trader buys back the asset (ideally for less than they sold it for). A long position means a trader has bought a currency expecting its value to rise. Once the trader sells that currency back to the market (ideally for forex basics a higher price than they paid for it), their long position is said to be ‘closed’ and the trade is complete.

- You’ll often see the terms FX, forex, foreign exchange market, and currency market.

- Yes, but not every regulatory jurisdiction offers the same protections for forex traders.

- Major currency pairs account for around 80% of the total volume in the forex market and include the EUR/USD, GBP/USD, USD/JPY, USD/CAD, USD/CHF, AUD/USD, and NZD/USD.

Success typically comes from managing risks while capitalizing on high-probability trading opportunities rather than seeking huge gains on individual trades. We introduce people to the world of trading currencies, both fiat and crypto, through our non-drowsy educational content and tools. We’re also a community of traders that support each other on our daily trading journey. Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have remaining (Tokyo is expensive!) and notice the exchange rates have changed. You go up to the counter and notice a screen displaying different exchange rates for different currencies. A forex trader will tend to use one or a combination of these to determine a trading style that best fits their personality.

Always trade carefully and implement risk management tools and techniques, such as stop loss and take profit orders. The aim of technical analysis is to interpret patterns seen in charts that will help you find the right time and price level to both enter and exit the market. Look for platforms that are user-friendly and offer robust analytics, trading tools, and real-time data. Popular options include MetaTrader 4, MetaTrader 5, as well as our own FXTM Trader. FXTM is an award-winning, regulated broker that offers competitive spreads, low commissions, and excellent customer support.

For beginners, it’s important to learn the basics, such as the different markets, the most traded pairs, and getting to know some of the simpler trading strategies. Swing trading falls somewhere between day trading and long-term investing. Positions are held for a few days to weeks, allowing traders to take advantage of medium-term price movements.

The Risk of Leverage in Forex Trading

- For example, you can use the information in a trend line to identify breakouts or a trend reversal.

- When accessing the forex market for the first time, it is crucial to realize the importance and size of this sector.

- For example, if the EUR/USD is consistently moving upwards, a trend trader would buy, anticipating further upward movement.

- A key rule to remember is that the longer the range, the stronger the breakout.

- Conversely, going “short” means profiting when the first currency weakens against the second.

After you’ve experimented with the broker’s trading platforms using a paper trading/demo account (see more on that below), you can open that live account and start trading with real money. Examine your broker’s funding options and deposit a small amount of risk capital that you plan on begin trading with. Once you’ve consumed forex educational content, studied the markets, and developed a detailed trading plan, it’s time to open an account with a highly rated, well-regulated forex broker. I always recommend choosing a broker that is licensed in multiple reputable jurisdictions. Saxo Bank A/S and its entities within the Saxo Bank Group provide execution-only services, with all trades and investments based on self-directed decisions. Analysis, research, and educational content is for informational purposes only and should not be considered advice nor a recommendation.

The formations and shapes in candlestick charts are used to identify market direction and movement. The FX market is a global, decentralized market where the world’s currencies change hands. Yes, Forex trading can indeed be a full-time job for many individuals, but it’s essential to approach it with seriousness and dedication. You can use all of these platforms to open, close and manage trades from the device of your choice.

How to open a real trading account on MetaTrader4/5?

This strategy requires good timing and can be highly profitable, but it also carries a higher risk if the breakout is a false signal. For beginners, the amount you need to start forex trading varies based on your goals, risk tolerance, and the broker you choose. Many brokers have minimum deposit requirements, often ranging from USD 50 to several hundred dollars. Starting with a smaller amount can be wise, especially while you’re still learning the ropes. As a beginner, it’s wise to start with major currency pairs like EUR/USD or GBP/USD.

Commodity Outlook: Commodities rally despite global uncertainty

The Fibonacci trading strategy is certainly among the most favorable trading strategies, largely due to its simplicity and accuracy. This strategy involves the use of Fibonacci retracement levels, which are part of the Fibonacci sequence. Notably, there are many Fibonacci trading strategies that traders can implement, with each one having its own benefits. Getting to know the exact times of trading sessions is crucial, as many traders are looking for certain hours with high liquidity, tighter spreads, etc.

What Is the Forex Market?

Bullish and Bearish Market – The terms bullish and bearish describe the market condition or sentiment of a certain asset/market. A bullish market refers to a situation where the market is rising, while a bearish market refers to a situation where the market is falling. The terms come from the way in which a bull and a bear attack their opponent – a bull attacks in an upward direction while a bear attacks in a downward direction.

Learn forex basics

Saxo’s content may reflect the personal views of the author, which are subject to change without notice. Mentions of specific financial products are for illustrative purposes only and may serve to clarify financial literacy topics. Content classified as investment research is marketing material and does not meet legal requirements for independent research.

Because forex prices are quoted in pips (hundredths of a cent), prices can change hundreds of times per minute. Residents of countries that don’t have an official regulatory framework for local brokers that offer retail forex from a margin will need to seek out international forex broker alternatives. Check out our international forex country guides to find a reliable forex broker in your home country. Check out my guide to the best forex brokers in the industry to find highly rated, well-regulated forex brokers. The more precision you can bake into your trading strategy, the less you’ll have to think about on a day-to-day, trade-by-trade basis.

By following these steps with focus and dedication, you’re setting the stage for a potentially rewarding trading experience. Stay committed, keep learning, and adapt your strategies as you gain more insight into the market dynamics. Based on your risk tolerance, financial goals, and market analysis, develop a clear trading strategy. Whether it’s day trading, scalping, swing trading, or position trading, having a plan (and sticking to it!) is essential for navigating the forex market successfully. The foreign exchange (also known as forex or FX) market refers to the global marketplace where banks, institutions and investors trade and speculate on national currencies.

For novice traders, commencing with major pairs is advisable before venturing into minor or exotic pairs. With your trading account now established, the crucial phase is to develop a robust trading strategy. Delving into economic indicators such as Gross Domestic Product (GDP), employment rates, and interest rates provides valuable insights into a nation’s economic health and growth prospects. When an economy is strong and expanding, its currency typically becomes stronger. Currencies with high liquidity have a ready market and tend to exhibit a more smooth and predictable price action in response to external events.

You can essentially lose your money in a second, and even if your first trade is profitable, don’t get too excited about it. To be successful in forex trading, you need to form a long-term trading structure and understand how the forex market works. In my view, the best way to start is to invest money you can afford to lose and use this money to learn how the market works. This way, you’ll be able to find the strategy that works best for you.

This makes some points in a certain market crucial and, therefore, these levels can be used as signals to enter and exit positions. Although leverage is a huge benefit in forex trading, it is important to note that the higher the leverage you use, the higher the risk. In forex trading, there are three types of FX currency pairs – majors, minors, and exotic. Major currency pairs account for around 80% of the total volume in the forex market and include the EUR/USD, GBP/USD, USD/JPY, USD/CAD, USD/CHF, AUD/USD, and NZD/USD. The primary currency pairs, such as EUR/USD and GBP/USD, enjoy significant popularity due to their excellent liquidity, ensuring smooth entry and exit from positions.

Chettinad Snacks

Chettinad Snacks Coconut Oil

Coconut Oil Cookies

Cookies General

General Gingelly Oil

Gingelly Oil Groundnut Oil

Groundnut Oil Herbal

Herbal Instant Mix

Instant Mix Karuppatti

Karuppatti Noodles

Noodles Panchadeepam Oil

Panchadeepam Oil Pongal Mixes

Pongal Mixes

Leave a Reply