Categories

TOP RATED PRODUCTS

-

DIA CAARE MILLET COOKIES

DIA CAARE MILLET COOKIES

₹22.00Original price was: ₹22.00.₹15.00Current price is: ₹15.00. -

Childrens Choice Millet Cookies - 70gm

Childrens Choice Millet Cookies - 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

Dia Caare Millet Cookies 70gm

Dia Caare Millet Cookies 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

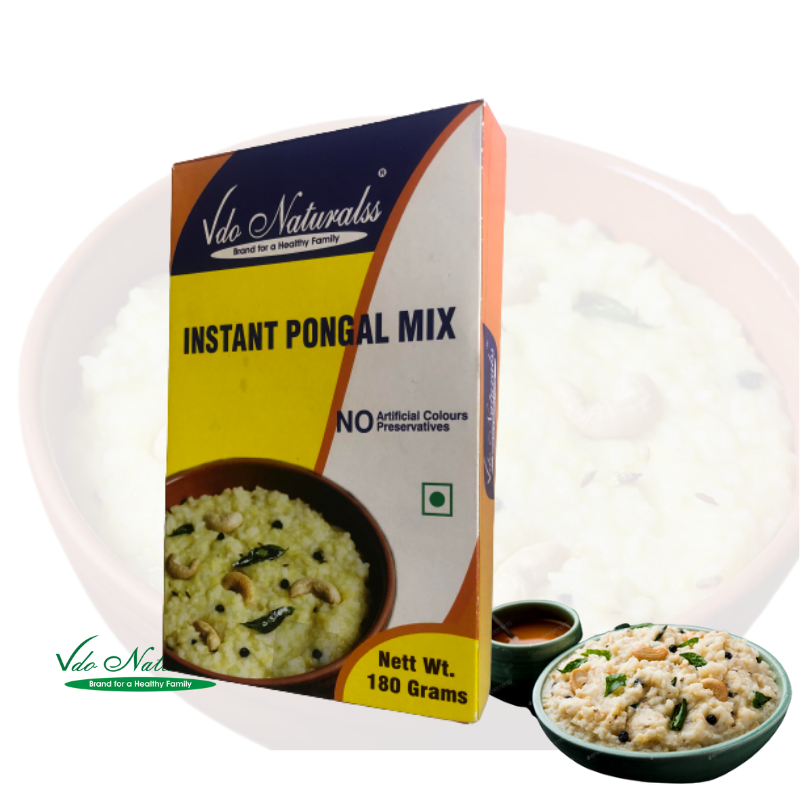

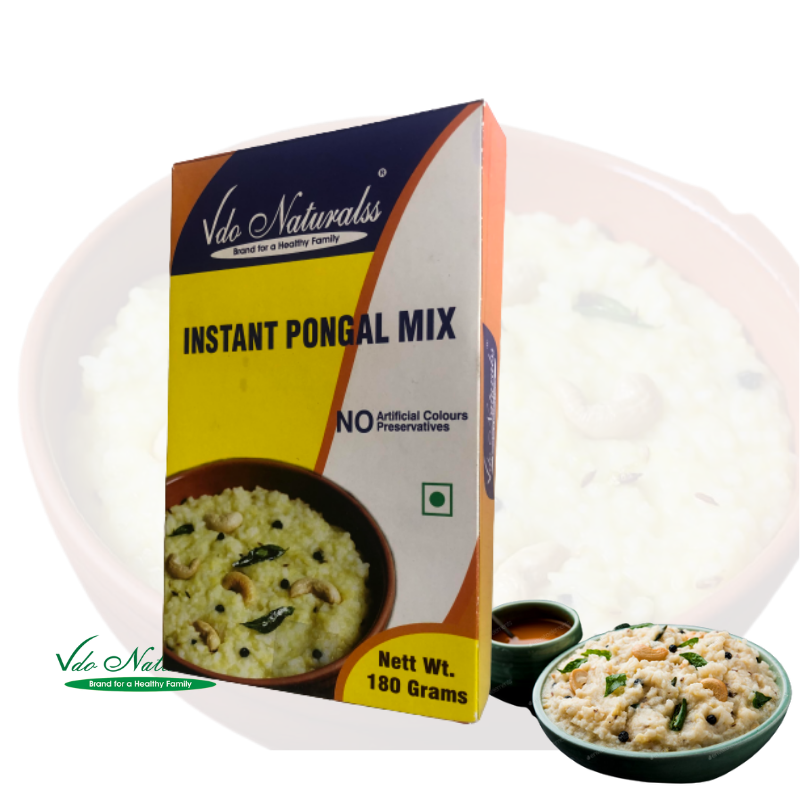

Instant Rice Pongal Mix 180gm

₹65.00

Instant Rice Pongal Mix 180gm

₹65.00

-

Instant Little Pongal Mix

Instant Little Pongal Mix

₹98.00Original price was: ₹98.00.₹73.00Current price is: ₹73.00.

CLIENT'S TESTOMONIAL

Varadharajan

Finest quality and wide range of cold pressed oils. Legacy and natural shop. Best place for buying any oil be that cold pressed coconut , groundnut oil. If you compare the oils available with other branded oils in the market, these are economical and of good quality. The groundnut oil sold by the store is one of the best.

Sandeep

Professional and timely handling of orders. Good customer support. Quality of products is good. Am a repeat customer now! Surprised to see negative reviews of customer support. It is after seven months after the above review: I would 100% recommend. It happened so that during my recent order on receipt I found the packaging was open and two 1 ltr coconut oil were missing, it could be during transit. Was stunned with their response and action. Amazing levels of keeping customer happy. Keep up the levels please!

As mentioned, mark-to-market accounting provides a realistic financial picture, especially for businesses in the financial industry. Banks were listing the original price they paid for assets and only made changes on the books when those assets were sold. In contrast to fluctuating accounting models is historical cost accounting, where a fixed asset is recorded on a balance sheet in terms of its original cost. These types of assets typically include company land or equipment that has depreciated over the course of its useful life, including assets such as buildings and machinery. Mark to market accounting offers significant value in the realm of pension accounting. It ensures that a firm’s pension obligations accurately represent current market conditions and are not merely based on historical costs.

How Short-Term Rentals (STRs) Unlock Deductions For Real Estate Investors

- For instance, in futures trading, accounts are marked daily to account for changes in the value of contracts.

- The use of models and assumptions becomes necessary, which introduces a level of subjectivity into the process.

- Mark to market increases transparency for stakeholders, but it also amplifies income statement volatility and raises governance demands that auditors and consultancies—Deloitte, PwC and KPMG among them—must address.

- Portfolio managers rely on MTM valuation to provide accurate daily performance metrics to clients and regulators.

This mark-to-market system means that financial statements are always showing a picture in real-time, aligning values with the ebbs and flows of the market, as outlined in FAS 157, Fair Value Measurements. Understanding Marked-to-Market AssetsMarked-to-market (MTM) assets are financial instruments whose values are determined by the current market price. The primary reason for marking these assets to market is to provide a more accurate and up-to-date representation of a company’s or institution’s financial situation based on ever-changing market conditions. Mark to market (MTM) valuation method plays a crucial role in accurately reflecting the current worth of various financial instruments, such as stocks and bonds. In this section, we will dive deeper into which assets require marking to market versus those that follow historical cost accounting.

Mark to Market Examples in Futures

- This accounting practice, while legitimate under certain circumstances, became a tool for manipulation when used by Enron.

- At the end of each fiscal year, a company must report how much each asset is worth in its financial statements.

- Access to real-time market data has significantly enhanced the accuracy of mark to market accounting.

- Understanding the basics of mark to market (MTM) and its significance is crucial, especially in accounting, financial services, personal finance, and investing.

- By regularly adjusting these assets to their market value, companies can ensure that their financial statements accurately reflect their economic reality.

- Both the above process refers to recording of values of assets and liabilities in the financial statements, but the difference lies in the value that is finally recorded.

In adding up the assets of the company, this depreciation will be factored into the mark-to-market calculations. For example, a bank or other such institutional lender may have customers who default on their loans, which then turn into uncollectible bad debt. This method helps you ensure that your valuation of assets accurately reflects their present worth. In personal accounting, understanding Mark to Market (MTM) can be extremely valuable, especially if you hold investments or other financial instruments that fluctuate in value. Mark to Market (MTM) accounting is a strategy that records the value of an asset to reflect its actual market price.

The 2008 Financial Crisis

The principal cause of the bank’s failure was its large holdings of long-term government bonds and securities. While relatively safe, the securities lost market value when interest rates on newly issued Certified Bookkeeper securities rose. The elections under paragraphs (1) and (2) may be made separately for each trade or business and without the consent of the Secretary. Such an election, once made, shall apply to the taxable year for which made and all subsequent taxable years unless revoked with the consent of the Secretary. Rules similar to the rules of subsections (b)(4) and (d) shall apply to securities held by a person in any trade or business with respect to which an election under this paragraph is in effect.

As we have reported previously, California has enacted a pair of climate-related reporting laws that apply to large entities doing business in California (SB 253 and SB 261, as modified by SB 219). This alert provides an update on only the most recent events; please see previous alerts for a broader overview of the laws’ requirements…. Yes, during periods of economic instability or intense price variation, MTM can lead to significant swings in reported earnings and equity value. MTM directly influences profitability records and shareholders’ equity and can significantly affect public opinion of your business and stock prices. This approach is a little different from traditional cost accounting, offering unique advantages that can be vital for your business.

- This allows the fund managers to calculate the fund’s net asset value (NAV), which tells investors what their units are worth on any given day.

- Mark-to-market accounting is particularly relevant for investors who actively trade securities or hold assets that are subject to market fluctuations.

- By valuing assets at their current market price, financial statements offer a more realistic view of a company’s financial health.

- Investors gain clarity on the current value of an organization’s assets, leading to more informed decisions.

- These guidelines require companies to use fair value measurements for their financial assets and liabilities, which includes using market prices where available.

- However, it is important for companies to be aware of the possible risks and ensure that they are avoided.

- This tiered approach acknowledges a fundamental reality of markets—some assets are more straightforward to value accurately than others.

- Mark to market (MTM) is an accounting method that measures the current value of a company’s assets and liabilities, rather than their original price.

- Simultaneously, the company disclosed a $1.2 billion reduction in the value of shareholders’ equity due to write-downs on poorly performing assets.

- The profit could be expressed over statement periods, no matter if the positions are opened or closed.

Neither mark to market accounting tastylive nor any of its affiliates are responsible for the products or services provided by tasty Software Solutions, LLC. Cryptocurrency trading is not suitable for all investors due to the number of risks involved. The value of any cryptocurrency, including digital assets pegged to fiat currency, commodities, or any other asset, may go to zero. Its fair value could be estimated using the income approach, projecting future cash flows from licensing the patent.

Investment Management Applications

The concept contribution margin of measuring fair value is defined by SFAS 157–Fair Value Measurements (replaced by ASC 820). According to this standard, fair value is “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” Once you make the election, you have to continue to use the mark-to-market method for all future years. You can change the election only with the consent of the Internal Revenue Service, and they generally won’t grant this consent if your reason for changing is simply that the election didn’t turn out to your advantage. If you’re a trader, you may choose whether or not to make the mark-to-market election. Receive a detailed risk assessment to assist in lowering problem areas that could wipe out all of your assets with one wrong move.

Chettinad Snacks

Chettinad Snacks Coconut Oil

Coconut Oil Cookies

Cookies General

General Gingelly Oil

Gingelly Oil Groundnut Oil

Groundnut Oil Herbal

Herbal Instant Mix

Instant Mix Karuppatti

Karuppatti Noodles

Noodles Panchadeepam Oil

Panchadeepam Oil Pongal Mixes

Pongal Mixes

Leave a Reply