Categories

TOP RATED PRODUCTS

-

DIA CAARE MILLET COOKIES

DIA CAARE MILLET COOKIES

₹22.00Original price was: ₹22.00.₹15.00Current price is: ₹15.00. -

Childrens Choice Millet Cookies - 70gm

Childrens Choice Millet Cookies - 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

Dia Caare Millet Cookies 70gm

Dia Caare Millet Cookies 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

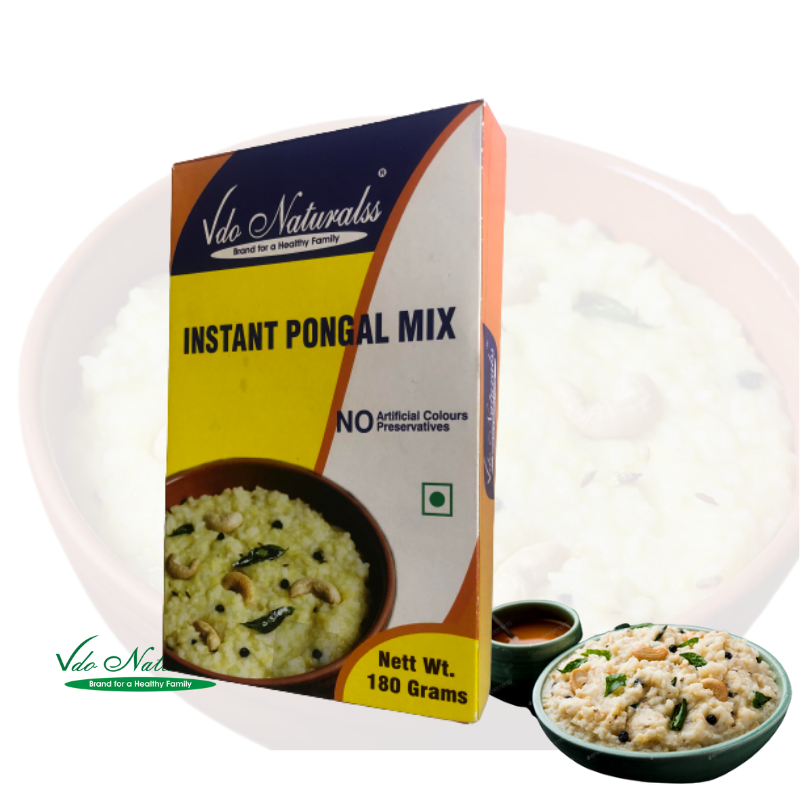

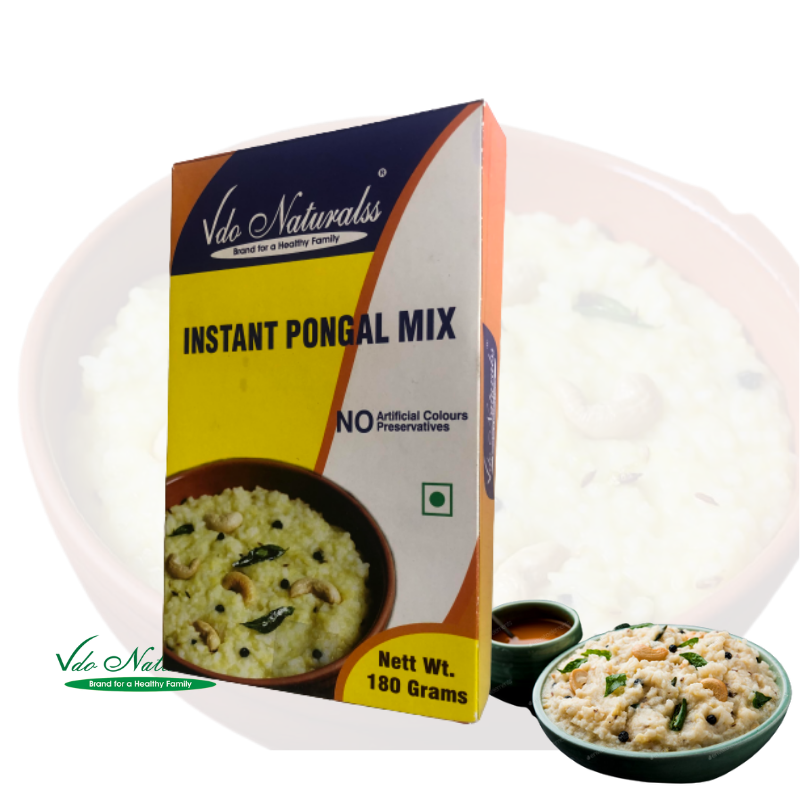

Instant Rice Pongal Mix 180gm

₹65.00

Instant Rice Pongal Mix 180gm

₹65.00

-

Instant Little Pongal Mix

Instant Little Pongal Mix

₹98.00Original price was: ₹98.00.₹73.00Current price is: ₹73.00.

CLIENT'S TESTOMONIAL

Varadharajan

Finest quality and wide range of cold pressed oils. Legacy and natural shop. Best place for buying any oil be that cold pressed coconut , groundnut oil. If you compare the oils available with other branded oils in the market, these are economical and of good quality. The groundnut oil sold by the store is one of the best.

Sandeep

Professional and timely handling of orders. Good customer support. Quality of products is good. Am a repeat customer now! Surprised to see negative reviews of customer support. It is after seven months after the above review: I would 100% recommend. It happened so that during my recent order on receipt I found the packaging was open and two 1 ltr coconut oil were missing, it could be during transit. Was stunned with their response and action. Amazing levels of keeping customer happy. Keep up the levels please!

This occurred during the Great Depression and the 2008 financial crisis when consumers and businesses cut back on spending, leading to prolonged economic downturns. For instance, in cash-dependent societies, transactions may take longer, reducing money velocity. In contrast, economies with widespread digital payment adoption experience faster money circulation, as transactions occur instantly. The increasing use of cryptocurrencies and central bank digital currencies (CBDCs) may further enhance money velocity in the future.

How do interest rates impact the flow of money?

Central banks face the challenge of maintaining economic stability while addressing low velocity and potential deflationary pressures. To mitigate these issues, they may need to adopt new monetary policy tools or reevaluate their approach to inflation targeting. The velocity of money continues to be an area of interest for economists, as it offers valuable insights into the functioning of monetary systems and economic trends. For example, suppose the central bank increases the monetary base by buying government securities in the open market.

- Additionally, the increasing use of digital currencies and payment methods can complicate the calculation of the velocity of money.

- This relationship underscores the significance of velocity of money in assessing business cycles.

- By understanding and calculating the velocity of money, traders, investors, and policymakers can gain a deeper understanding of economic trends and make more informed decisions.

- Understanding the velocity of money provides valuable information to economists, policymakers, and investors, enabling them to make more informed decisions and predictions.

- Have you ever wondered how money flows through an economy, and how quickly it circulates from one person to another?

In simpler terms, it signifies how many times, on average, each unit of currency is exchanged for goods and services within an economy during a specific period. Economists commonly employ this measurement in assessing the health and vitality of an economy, as a high velocity indicates a robust, expanding economy. Interest rates – When interest rates are low, borrowing money becomes cheaper, which can lead to increased spending and investment. On the other hand, when interest rates are high, borrowing becomes more expensive, and people may be more hesitant to spend money, which can slow down the velocity of money. High consumer confidence often leads to increased spending, as individuals are more willing to invest in goods and services. This heightened spending can boost the velocity of money, indicating a healthy and vibrant economy.

Assessing market conditions through money circulation trends

The monetary base is the total amount of currency and reserves in the economy, which includes both physical currency and commercial banks’ reserves at the central bank. The monetary base plays a vital role in determining the supply of money in the economy, which affects the velocity of money. The velocity of money is the rate at which money circulates in the economy, and it is an essential metric for measuring the economy’s health. On the other hand, a decline in money velocity may signal economic stagnation or recession.

Factors such as consumer confidence, income levels, and saving habits can influence how quickly money circulates in the economy. For example, if a country’s GDP is $2 trillion and its money supply is $500 billion, the velocity of money would be 4. This means that, on average, each unit of currency was used four times to purchase domestically-produced goods and services within the specified time period.

Final thoughts on monitoring money velocity for economic advantage

As a result of these policies, banks’ excess reserves rose from $1.8 billion in December 2007 to $2.7 trillion in August 2014. Banks should have used these reserves to make more loans, putting the credit into the money supply. It also shows how the expansion of the money supply has not been driving growth. That’s one reason there has been little inflation in the price of goods and services. It means families, businesses, and the government are not using the cash on hand to buy goods and services as much as they used to.

Impact of Money Velocity on Economic Health

Conversely, when they expect deflation, they will hold onto their money, reducing the velocity of money. This theory highlights the importance of expectations and how they affect economic behavior. Government policy – Government policies can have a big impact on the velocity of money. For example, if the government implements policies that encourage spending or investment, this can help increase the velocity of money. On the other hand, if the government implements policies that discourage spending or investment, this can slow down the velocity of money. Consumer behavior plays a significant role in determining the velocity of money.

- From a policy perspective, understanding the velocity of money can inform decisions about monetary policy.

- Money velocity appeared to have bottomed out at 1.435 in the second quarter of 2017 and was gradually rising until the global recession triggered by the COVID-19 pandemic spurred massive U.S.

- The velocity of money is calculated by dividing the nation’s economic output by its money supply.

- The level of income individuals have directly impacts their spending patterns.

- All you need to know is the gross domestic product (GDP) of the country whose money supply you want to examine and the specific money supply you want to examine.

Velocity of money is the rate at which currency moves within an economy and indicates the frequency of financial transactions. It is measured as a ratio of gross domestic product (GDP) to a country’s M1 or M2 Best cfd trading platform money supply. Usually, when the velocity of money is high, the economy is strong and expanding. When low, the economy may be in recession and indicating a reluctance by people and businesses to spend. Economists calculate the velocity of money by dividing GDP by M1 or M2.

Conclusion: Implications and Future Perspectives on Velocity of Money

Historically, there have been instances where velocity of money has served as a critical predictive tool for understanding business cycles. For example, in the late 1920s, economists observed a sharp increase in velocity before the stock market crash and subsequent Great Depression. Similarly, during the late 1980s, the Federal Reserve began raising interest rates to combat inflationary pressures, which eventually led to a recession. In both cases, the velocity of money provided valuable insights into impending economic downturns. The velocity of money is a crucial concept within the realm of finance and economics that measures the rate at which money circulates through an economy.

Thus, both parties in the economy have made transactions worth $400, even though they only possessed $100 each. OneMoneyWay is your passport to seamless global payments, secure transfers, and limitless opportunities for your businesses success. As a result, boomers are downsizing and pinching pennies, in turn slowing economic growth. The Dodd-Frank Bank Reform and Consumer Protection Act allowed the Fed to require banks to hold more capital. That meant banks continued to hold excess reserves instead of extending more credit through loans.

Understanding the Monetary Base

Understanding the velocity of money provides valuable information to economists, policymakers, and investors, enabling them to make more informed decisions and predictions. As you continue exploring the realm of finance, keep the velocity of money in mind as an essential concept for assessing the health and potential of economies around the world. Expansionary monetary policy, used to stop the 2008 financial crisis, may have created a liquidity trap. Velocity of money is one factor that economists use to assess potential inflationary pressures in an economy. While it doesn’t directly predict inflation, a rapid increase in velocity of money may be a sign of an overheating economy and, possibly, rising prices.

Situations where money velocity may be misleading

It can provide insights into the effectiveness of monetary policies and help forecast economic direction. By understanding the velocity of money, policymakers can make informed decisions that can help promote economic growth and stability. The velocity of money is a crucial aspect of any economy, and it has been a topic of discussion for many years. Understanding the velocity of money can help in forecasting the direction of the economy, as well as the effectiveness of monetary policies. The velocity of money refers to the rate at which money changes hands between individuals and businesses.

Chettinad Snacks

Chettinad Snacks Coconut Oil

Coconut Oil Cookies

Cookies General

General Gingelly Oil

Gingelly Oil Groundnut Oil

Groundnut Oil Herbal

Herbal Instant Mix

Instant Mix Karuppatti

Karuppatti Noodles

Noodles Panchadeepam Oil

Panchadeepam Oil Pongal Mixes

Pongal Mixes

Leave a Reply