Categories

TOP RATED PRODUCTS

-

DIA CAARE MILLET COOKIES

DIA CAARE MILLET COOKIES

₹22.00Original price was: ₹22.00.₹15.00Current price is: ₹15.00. -

Childrens Choice Millet Cookies - 70gm

Childrens Choice Millet Cookies - 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

Dia Caare Millet Cookies 70gm

Dia Caare Millet Cookies 70gm

₹70.00Original price was: ₹70.00.₹53.00Current price is: ₹53.00. -

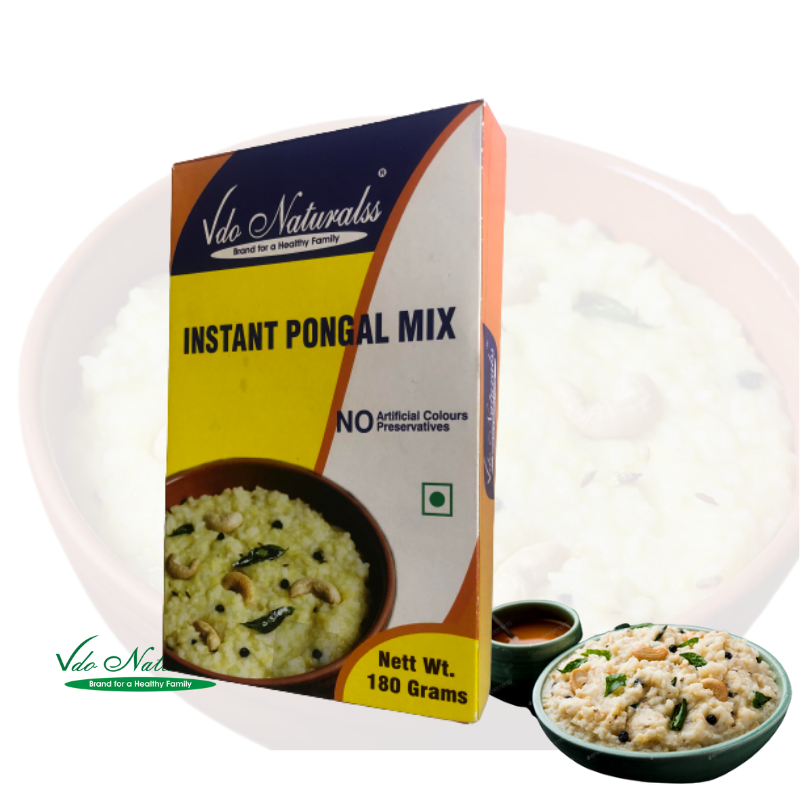

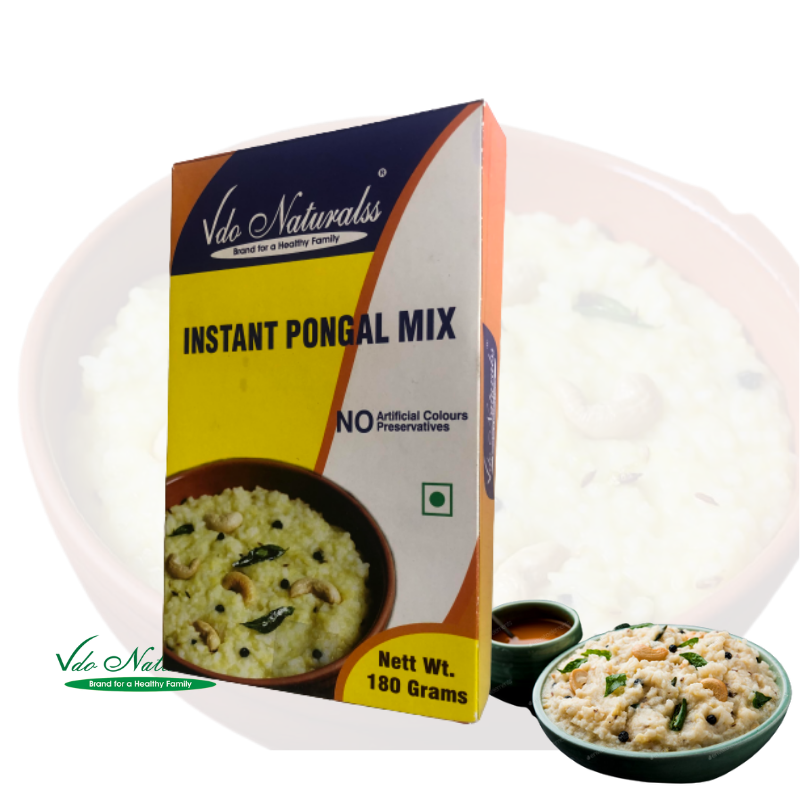

Instant Rice Pongal Mix 180gm

₹65.00

Instant Rice Pongal Mix 180gm

₹65.00

-

Instant Little Pongal Mix

Instant Little Pongal Mix

₹98.00Original price was: ₹98.00.₹73.00Current price is: ₹73.00.

CLIENT'S TESTOMONIAL

Varadharajan

Finest quality and wide range of cold pressed oils. Legacy and natural shop. Best place for buying any oil be that cold pressed coconut , groundnut oil. If you compare the oils available with other branded oils in the market, these are economical and of good quality. The groundnut oil sold by the store is one of the best.

Sandeep

Professional and timely handling of orders. Good customer support. Quality of products is good. Am a repeat customer now! Surprised to see negative reviews of customer support. It is after seven months after the above review: I would 100% recommend. It happened so that during my recent order on receipt I found the packaging was open and two 1 ltr coconut oil were missing, it could be during transit. Was stunned with their response and action. Amazing levels of keeping customer happy. Keep up the levels please!

If the account is not cleared, it can accumulate payments indefinitely, leading to confusion, inaccurate balances, and difficult audits. Think of this as a staging area where payments are collected before being formally deposited. Imagine a scenario where a business receives several customer payments throughout the day—some by check, others by cash. Doing so allows you to skip the longer workflow because each transaction gets processed as a single transaction, meaning there’s not a chance for it to show up what is accounts receivable as a lump sum payment on your bank statement. Typically, when you make multiple bank deposits on one trip, the bank combines all individual checks into one transaction. Reconciling these mismatched entries requires manually clearing the bank deposit against multiple book entries, which is inefficient and prone to error.

Businesses that accept mostly electronic payments often find little or no activity in the undeposited funds account, simplifying their accounting process. By temporarily holding these payments in the undeposited funds account, you can group them into a single deposit transaction that matches the bank’s lump sum deposit. This helps catch any unmatched payments and ensures the undeposited funds account balance is accurate. Ensure that all payments go first into undeposited funds and then are deposited in batches that match bank deposits.

Tracking and Recording Undeposited Funds

These could be cash, checks, or credit card payments that have been collected but not yet processed through the bank. These funds are typically recorded in a temporary account called “Undeposited Funds” in the company’s accounting system. Why not set up QBO to make deposits directly into the bank account as a default?

Bank reconciliation is the process of comparing the business’s accounting records with the bank statement to ensure all transactions are accurately recorded and no errors exist. The undeposited funds account works by temporarily holding customer payments until they are combined into a deposit and posted to the bank account in the accounting software. This temporary categorization helps businesses keep track of their incoming cash and ensures that the amount shown in their bank account matches the actual deposits. In some cases, businesses may accidentally classify payments as undeposited funds when they should be posted directly to revenue or other accounts, skewing financial reports. If payments remain in undeposited funds for an extended period without being deposited in the bank account, it creates a false impression of available cash. Regularly clearing undeposited funds by making deposits in the accounting system ensures that cash flow reports accurately reflect bank balances.

When depositing to a bank, QuickBooks automatically matches these as a grouped deposit, ensuring seamless reconciliation. Because each transaction is processed as a unique transaction, eliminating the possibility that it would appear as a lump sum payment on your bank statement, doing this enables you to skip the lengthy processes. In other words, the information on your bank statement and your itemized bank deposit sheet are not the same. The account for undeposited funds is intended to be used only temporarily. In accounting, managing cash flow is essential for keeping your business operations running smoothly.

How to use QuickBooks Online’s Undeposited Funds account

For businesses with tight cash flow, this can lead to poor decisions, such as overspending or missing payment deadlines. Clear trails showing when payments were received, deposited, and reconciled increase transparency and credibility. Deleting or misusing this account disrupts your records and complicates bank reconciliations.

QuickBooks Online resources

This will clear the undeposited funds account by moving those payments into the dummy account. The payments remain in the undeposited funds account, causing it to grow over time. Your accounting software will sum these payments and create a single deposit transaction to the bank account. This feature typically allows you to see all the individual payments currently in the undeposited funds account. Some businesses, particularly those that receive payments electronically or directly into their bank accounts, may never need to interact with this account.

Using Undeposited Funds in QuickBooks Online

When that bulk deposit drops into your QBO bank feed, it is your responsibility to match the portion of the money to the right client’s outstanding payment due. If legacy undeposited funds create problems, the dummy account method can be a solution, but it should be used cautiously and with professional guidance. This approach minimizes the need to handle physical deposits and use undeposited funds. Connect your bank and payment accounts to your accounting software through bank feeds. Another alternative is integrating payment processing software or point-of-sale (POS) systems with your accounting platform. Accounting software often provides reports showing undeposited funds aging or details, helping accountants monitor and manage the accounts.

For example, making daily or weekly deposits in the accounting software reduces the number of transactions held in undeposited funds. In these cases, there are alternative approaches to managing customer payments and deposits that can simplify accounting processes. While the undeposited funds account serves a useful purpose in many businesses, some may find it cumbersome or unnecessary.

- As deposits come through the bank feed, single payments will automatically prompt a match (Match Payment).

- Next, in the bank deposit window, select this dummy account and group all old undeposited payments that need clearing.

- Understanding these misconceptions helps users handle the undeposited funds account correctly and maintain accurate records.

- The importance of the undeposited funds account lies in its ability to improve the accuracy and clarity of financial records, especially regarding bank reconciliations.

Reasons to use the Undeposited Funds account

Moreover, we will ensure that your undeposited account entries are compiled and reconciled in time. This ensures that settlement checks are correctly recorded in their respective IOLTA accounts without causing sync issues with your bank feed. The “Undeposited Funds” account in QuickBooks Online is essentially a holding account. One key feature that helps you do this is the “Undeposited Funds” account.

Recording Payments Received

The Undeposited Funds account lets you group these payments together, so when you’re ready, you can deposit them into your bank account all at once. If undeposited funds are not tracked properly, it could lead to errors in the financial statements and cause discrepancies in the bank reconciliation process. In a business’s accounting system, undeposited funds serve as a holding account until the money is physically deposited into the bank.

- Undeposited funds refer to any payments a business has received but has not yet deposited into its bank account.

- Our experts understand the implication of this particular account and take proactive steps to mitigate risk.

- The account appears on the balance sheet and may show a balance if payments have been received but not yet deposited.

- The undeposited funds account helps solve this problem by acting as a temporary buffer where payments await deposit.

- The accounting system reflects this by allowing the user to select the payments held in undeposited funds and group them into one deposit transaction.

Educate and train your team on the purpose and correct handling of undeposited funds. Establish and follow standardized procedures for payment entry, deposit grouping, and reconciliation. It is highly advisable to consult an accountant before using this method because it can affect financial statements and tax records.

Manage your accounting complications with the aid of Smart Accountants!

When business gets hectic, you’ll be able to scale to a larger platform—or maybe even hire a bookkeeper! When business is thriving, bookkeeping has a way of sneaking up on you. Therefore, this simple error required the business to pay taxes on $850,000 of additional income that had never been received. Tax time came along, and because of a bookkeeping error, the total revenue of the business was inflated by $850,000!

Ignoring this holding step often leads to significant discrepancies between internal records and the official bank statement. Proper use of the UF account is foundational to achieving straightforward and accurate bank personal loan calculator reconciliation. It can slow your workflow and affect the accuracy of your bookkeeping and accounting.

Choose a name that identifies it as a dummy or temporary account to avoid confusion. Poorly documented or unexplained balances can raise red flags, requiring additional explanations. However, there are effective ways to reduce or even avoid dealing with this account altogether. Some users mistakenly believe this balance represents missing money or an error. FreshBooks is made with small business owners and freelancers in mind.

A lingering balance means payments are still waiting to be deposited in the software and matched to a bank deposit. Confusion arises because the undeposited funds account is often a default setting in accounting software for receiving payments. Once payments are grouped and deposited as a single amount, the accounting records align with the bank’s records. If payments were posted individually as deposits, the amounts would not match the bank statement, causing reconciliation discrepancies that require time-consuming investigation.

What Are Undeposited Funds?

Without the undeposited funds account, each payment would be recorded as a separate deposit, which would not match the single, combined deposit shown by the bank. The undeposited funds account exists to bridge the gap between these individual payments and the combined deposit that appears on the bank statement. The Undeposited Funds account in QuickBooks Online is a powerful tool for managing incoming payments and simplifying the bank deposit process. This process helps streamline your accounting and allows you to record payments as they are received, without needing to immediately reflect the deposit in your bank account. It temporarily holds payments (such as checks, credit card payments, or cash) before they are deposited into your bank account.

Accounting Enigmas: Undeposited Funds Account

When you make deposits at the bank, collect your deposit slip or bank statement showing the lump sum deposit that includes all payments you combined. One of the most important tasks for anyone using an accounting system that includes an undeposited funds account is learning how to properly clear it. The account how do i import last years tax return appears on the balance sheet and may show a balance if payments have been received but not yet deposited.

Chettinad Snacks

Chettinad Snacks Coconut Oil

Coconut Oil Cookies

Cookies General

General Gingelly Oil

Gingelly Oil Groundnut Oil

Groundnut Oil Herbal

Herbal Instant Mix

Instant Mix Karuppatti

Karuppatti Noodles

Noodles Panchadeepam Oil

Panchadeepam Oil Pongal Mixes

Pongal Mixes

Leave a Reply